Buying a condo in Thailand

Thailand is one of the most visited countries in the world, so it’s no surprise that some of those visitors may want to make the Kingdom their home.

At first, the hardest part seems like choosing between living on a world-class beach, among lush forests or in one of the busiest cities in the world. But look a little deeper, and you’ll see the many steps to owning a condo can also discourage foreign buyers.

So, we’ve created a step-by-step guide that starts from planning your condo budget all the way until you receive the deed for a stress-free process.

Can you buy a condo as a foreigner?

Simply put, yes – as long as 51% of the building’s floor area is owned by Thai citizens.

When you buy a unit, you enter into a freehold condominium agreement.

This means that you own your room, a part of the common areas (gyms, pools, parking lots), and have a seat on the homeowner’s board. How big your vote on the board is depends on how much of the building you own.

Condo prices in Thailand: what can you afford?

Before you buy a condo, you should take a hard look at your finances and decide if it’s the right choice for you.

Condo prices in Thailand vary depending on the location, amenities, building’s age, and developer. We’ve classified them by 3 categories: Budget, Standard and High-End.

Budget

We grouped 1 Bedroom (1BR) condominiums that are under ฿2.5 million (~USD83,116) as ‘budget’. Studio condominiums – which are usually 30 square metres – can go as low as ฿1 million (~USD33,500). A low price always sounds good, but it’s important to consider a number of factors:

- If a studio apartment has enough space for you, and if you’re planning on living with someone in the future. If so, would a studio apartment be enough space for 2-3 people?

- Is the location accessible, or is it accessible-adjacent? Public transport is sometimes a pain, but needing to call a Grab to even get to the nearest BTS or MRT station would be even more so.

- Is the quality of the building what you want? Do not compromise your safety and security for a smaller price tag.

Right now, budget condominiums seem to be everywhere – from listings on electrical posts to verified property sites like ddproperty and hipflat. This is because Covid-19 has forced many people to quickly liquidate their assets and investments, resulting in heavily discounted condos.

Do note though, that sometimes, people are looking to sell their down payments in order to transfer ownership and the mortgage, but not the entire condominium. So, like anything else, be sure to do your due diligence.

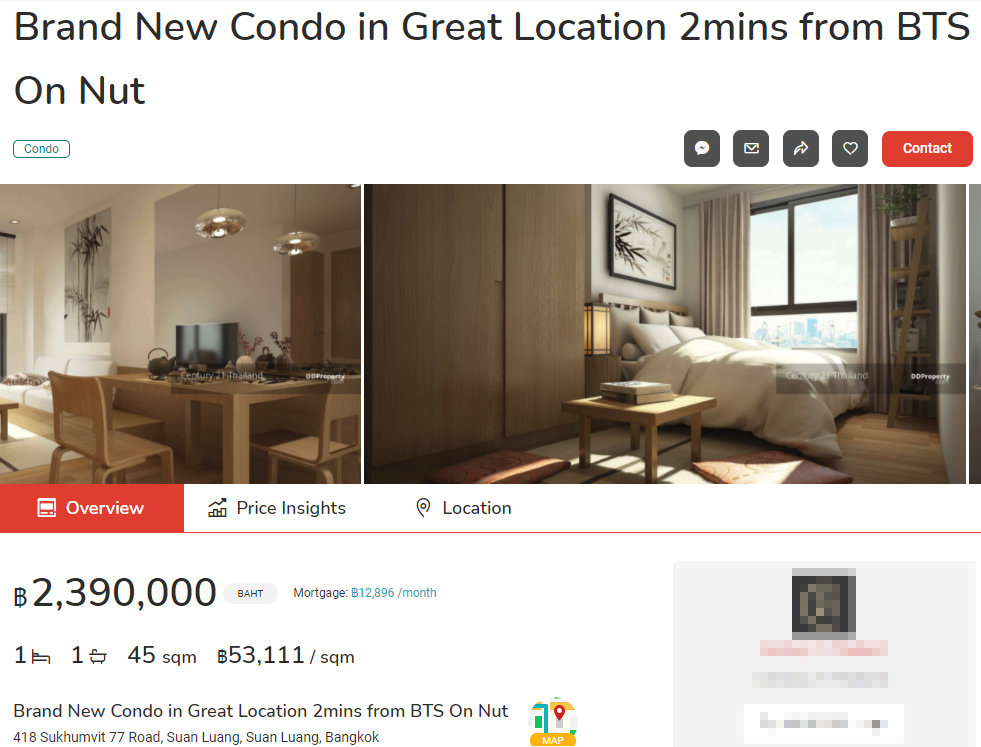

Some of these condominiums are even brand new

Screenshot: ddproperty

For a 20-year mortgage for a budget condominium, we’d recommend an income of at least ฿40,000 (~USD1,338) per month. Depending on your down payment, the monthly payments for your mortgage would fall around ฿8,500 (~USD283), which should leave you with enough for other expenses.

Standard

A one-bedroom condo in a mid-range building in Sukhumvit or somewhere within 100 metres of the BTS Skytrain will cost at least ฿3 million (~USD100,381). Standard condominiums include buildings with 1BR units priced from ฿3-5 million.

These condominiums are priced higher due to their centrality in Bangkok, their amenities and sometimes, their brand names.

Driving around Bangkok you’ll see many “Ideo” buildings – they’re under the Ananda umbrella brand. This one in Rama IX has a coworking space, gym and pool and rooms start from ฿3.5 million (~USD115,626)

Driving around Bangkok you’ll see many “Ideo” buildings – they’re under the Ananda umbrella brand. This one in Rama IX has a coworking space, gym and pool and rooms start from ฿3.5 million (~USD115,626)

Image credit: Ideo Rama IX

Famous developers like Ananda and Sansiri have recently started high-rises with smaller fully-furnished rooms and upscale amenities such as a doorman, rooftop pool, and state-of-the art facilities like gyms and coworking spaces.

With newer buildings, the facilities always resemble those you’d see at a hotel, like a front desk. If they look too good for a normal condominium, it’s probably good to ask if it’s a condotel: a condominium with hotel services. While you may get the services you’ll also get an endless stream of tourists – when borders open, of course.

I used to rent a room in this gorgeous building right in the middle of the city and was very keen on purchasing a room later. However, after months of waking up to the sound of tourists’ suitcases falling or rolling luggage, and consistent photoshoots interrupting my swim, I decided against it.

I used to rent a room in this gorgeous building right in the middle of the city and was very keen on purchasing a room later. However, after months of waking up to the sound of tourists’ suitcases falling or rolling luggage, and consistent photoshoots interrupting my swim, I decided against it.

Image credit: Origin

These condos are often the ones you see advertised all over social media with ‘TODAY ONLY’ deals that sometimes offer a ‘free’ iPhone upon putting down a deposit. While the offers and gorgeous pictures may be tempting, it’s important to remember that these deposits are non-refundable – so don’t sign up just yet.

For a standard condominium, we’d recommend having an income of at least ฿70,000 (~USD2,334). On a 20-year mortgage, that would put your payments at around ฿12,500 (~USD418) or less, based on how much your down payment is.

High-End

The Ritz Carlton Residences in the Mahanakhon tower has a floor to ceiling marble bathroom. This 7 bedroom penthouse can be yours for ฿750 million (~USD25 million)

The Ritz Carlton Residences in the Mahanakhon tower has a floor to ceiling marble bathroom. This 7 bedroom penthouse can be yours for ฿750 million (~USD25 million)

Image credit: Property Hub

Thailand’s super luxury condominiums can start at ฿300,000 (~USD10,000) per square metre and offer a range of features. These can include full hotel-style services, if you decide on a hotel residence.

High-end condominiums like these cover a much wider range of prices than those we covered under Standard and Budget units. Because of this, it’s up to you to decide what you can afford on a monthly basis.

So, ask yourself these 3 questions before putting down a deposit on one of these ultra-luxe properties:

- If you’re getting a mortgage, can you realistically sustain your lifestyle and monthly payments?

- How much time will you be spending at home?

- If you’re looking at a hotel brand residence, are you willing to shell out hundreds of thousands of dollars for something you can experience on a nightly basis at the hotels?

Financing your condo

While finding that dream property in Thailand is definitely a moment to celebrate, sometimes the price isn’t a cause for joy.

Unless you’ve got your cash ready to do, you’ll have to take out a loan. Borrowing money in Thailand as a foreigner can be pretty complex, but that doesn’t mean it’s impossible.

Non-permanent residents

For those who do not have a work permit or Permanent Residency, there are two options:

- Overseas Mortgage: If a bank from your country operates in Thailand, they could be willing to offer a mortgage to you. It is really dependent on the bank and their rules. The most popular banks for this service are United Overseas Bank (UOB), and Industrial and Commercial Bank of China (ICBC)

- MBK Guarantee: The group has a monopoly on financing options for foreigners who wish to buy property in Thailand and will use the property as collateral.

Image credit: Thailand Law

Image credit: Thailand Law

Work permit holders, permanent residents and spouses of Thai nationals

Thai retail banks are more generous with mortgages to foreigners who are married to Thais. For married couples, you can either apply for a “joint-mortgage” or take one out in the Thai partner’s name and have the foreign individual act as a guarantor.

What’s required:

- Your age plus the duration of the loan period may not exceed 60 years

- A marriage certificate (translated in Thai if it’s not in English)

- A bank statement tracking back at least 6 months back from both of you

- A letter of employment from both of you

- Payslips dating back 6 months from both parties

- Thai spouse’s tabian baan, or housing registration

- In the event that they can’t locate it, they would have to go to an amphoe or municipal office to register for a new one.

Do note that the bank will make a decision based on both of your credit scores.

Major creditors in Thailand

Major creditors in Thailand

Image credit: Saksa Suomi

So, how do I buy it and what do I need?

The buying process is pretty straightforward, but requires great attention to detail. You will need:

- Multiple signed copies of the first page of your passport

- Copy of your passport page with your Thai visa stamp

- A translation of your name that matches all other official documents (work permit, previous leases etc.)

- Birth certificate

- Foreign quota from the condominium (that is, how much of the building is owned by non-Thai owners)

- You would need to ask the condominium to provide this document for you

- No Due Certificate (proof that you’ve paid common area fees)

- A receipt and confirmation letter from the condominium will suffice

- Bank confirmation letters (these confirm that you have received a loan or line of credit)

- Marriage certificate (if applicable)

Reservation

Once you’ve decided on your dream condo, the seller will propose a reservation fee, which is often separate from the down payment. This fee doesn’t guarantee ownership of the unit, but puts the room on hold from other buyers for the moment. The amount depends on the seller, the project, and your negotiation skills.

Documents you should ask from the seller:

- An official deed of the unit with their National ID Cards. Ensure that those match exactly, as this proves legitimate ownership

- Their tabian baan or ‘house registration’ to verify that the address registered as their ‘personal address’ is not the same as the one you’re purchasing.

Purchasing the condo

This is where things start to get official. The purchase agreement and the down payment (which ranges between 5% and 20% of the full price) are what officiate your ownership of the property. Like the reservation fee, the down payment is dependent on the seller as well as your negotiation skills.

Transfer and other administrative fees are usually split between the two parties.

Pro tip: If the seller is unwavering on the down payment, counter with a certain percentage of the taxes.

Money transfers

Here’s where the Department of Land gets involved. In order to purchase the property, the buyer has to provide proof that the funds are from overseas, including cash payments.

For electronic transfers over ฿1.5 million (~USD50,000) into the Kingdom, Thai banks will provide a Foreign Exchange Transaction Form, which will serve as proof. Explicitly state the transaction as “Purchasing a condominium in Thailand”.

You will need the following banking information from the seller:

- Bank Name

- Bank Account Name

- Bank Account Number

- Bank Branch and address

- SWIFT code

In the event that you’re bringing the amount in cash, you must declare it with customs. Provide the customs receipt and the funds to the seller’s bank, who will then issue a confirmation letter.

Proof of eligibility

In order to have your transaction verified by the Department of Land, you would have to provide them with:

- A copy of the front page of your passport, and the page with the visa stamp (for both you and your spouse, if applicable)

- A marriage certificate, which needs to be officially translated into Thai if it is not in English (if applicable)

- A letter from the condominium stating the foreign ownership ratio

- A No Due certificate certifying that all transactions have been settled

- All Foreign Currency Exchange Forms

- A cashier’s check with the total amount excluding taxes*

- The amount of taxes and government fees in cash

If you will be paying a mortgage on the property, it is required that an officer of the bank be present on the transaction date with a statement of the total mortgage amount.

*For the cashier’s check, the buyer must provide a cashier’s check with the total amount to be settled with the bank.

Signed, sealed and purchased

When all the documents have been verified, it’s time for the final step. Head down to the Department of Land. The buyer, seller and bank officer (if applicable) must all be present for the transaction.

Here, the seller, their representative or the bank presents the cashier’s check to the Department. If authorised by the Department of Land, the buyer and seller will sign the official property ownership transfer documents prepared by the officer.

It is official when the Department officer changes the name of the owner on the property title deed, and all taxes and transaction fees are paid to the officer.

Be thorough and realistic

There are many documents required to buy a condo as well as specific ways to handle them. It’s important to keep track of these, but it’s also important not to rush the process, as this could hinder your chances of getting the unit. After all, your safety and long term comfort is worth forking out extra for.

And with this handy guide, we hope the process of getting your first condo in Thailand seems a little less daunting.

Have suggestions for more articles like this? Let us know in the comments!

More things Thailand:

- Singaporean Restaurants In BKK For Those Missing The Taste Of The Lion City

- Wat Arun: Bangkok’s Most Iconic Temple With Photogenic Architecture & Chao Phraya River Views

- Krabi’s Ao Thalane Is A Hidden Lagoon With Landscapes Straight From ‘Avatar’

- Erawan Museum Is A Gorgeous Must-Visit Spot Near BKK With Thai Fairytale Vibes

Cover images adapted from: Richmonts (L), Ideo Rama IX (R)